AI-Powered Insurance Assistant

Modernizing Claims, CX & CRM for Tier 2 Insurers with GraphRAG and Multi-Agent AI

The insurance industry faces significant barriers to modernization

Outdated infrastructure creates data silos, hindering innovation and efficiency across the insurance value chain.

Manual workflows lead to lengthy settlement times (averaging 30+ days), high operational costs, and frustrated customers.

Lack of personalization and slow response times result in low customer satisfaction and retention rates.

High costs, limited technical expertise, and complex implementation create a growing competitive gap for Tier 2 insurers.

An intelligent, automated platform that transforms insurance operations from the ground up

Automates document analysis, fraud detection, and claims routing, reducing settlement times by up to 70% and improving accuracy by 35%.

AI-driven data analysis and predictive modeling reduce underwriting time by 60% while maintaining rigorous risk assessment.

24/7 personalized service through AI chatbots and seamless CRM integration, boosting customer satisfaction scores by up to 45%.

Combines knowledge graphs with vector retrieval for unparalleled context-aware processing and regulatory traceability.

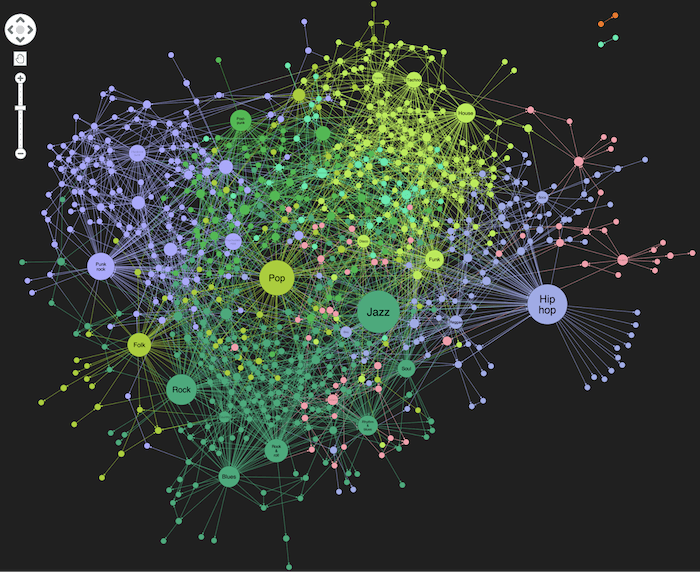

Sophisticated agentic AI model combining knowledge graphs with vector retrieval

Maps intricate connections between policies, claims, vessels, and regulations for unparalleled, context-aware processing that mimics expert-level reasoning.

Provides a clear, auditable trail for every automated decision, ensuring ironclad compliance with GCC and DIFC regulations.

Multiple specialized AI agents work together to handle complex workflows from start to finish, each focusing on specific tasks within the insurance process.

By enriching LLM prompts with structured, relationship-aware knowledge, we provide far more accurate and reliable outcomes than traditional AI systems.

Our leadership team combines deep insurance expertise with maritime operations experience

Founder & CEO

A visionary leader with over 15 years of experience in marine insurance and digital transformation. Parvind has a proven track record of implementing cutting-edge AI solutions for major insurers and previously worked with LTI in the US.

LinkedIn

Co-Founder & COO

A maritime operations veteran with over 20 years of global leadership experience. Chris previously served as Global Head of Operations at Britoil Offshore Services, managing complex, multi-vessel operations across the Middle East, West Africa, and Asia Pacific.

LinkedInThe SageInsure founding team represents a unique Danish-Indian partnership, forged from a shared history with the global engineering powerhouse Larsen & Toubro (L&T). This fusion of cultures, perspectives, and expertise creates the perfect recipe for a successful venture in the complex marine insurance landscape of the GCC region.

Series A funding to accelerate growth and expand our presence in the GCC marine insurance market

Enhance GraphRAG capabilities and expand knowledge graph coverage.

Hire AI engineers, domain experts, and customer success specialists.

Establish presence in key GCC markets with region-specific compliance.

Develop targeted campaigns and build brand awareness.

Join us in transforming marine insurance operations with GraphRAG-powered intelligence

Begin with a data assessment workshop to identify key sources and establish integration pipelines for your historical marine claims data.

Customize the marine insurance knowledge graph schema to align with your specific business processes and regulatory requirements.

Launch a focused pilot with human-in-the-loop validation to demonstrate value and refine the solution for your specific needs.